What We Do

Home > What We Do

We evaluate potential targets or merger partners as well as financial and strategic alternatives. We advise on strategy, timing, structure, financing, pricing, and we assist in negotiating and closing transactions.

We advise on sales and auctions in both strategic and distressed situations. We may also advise on financial and strategic alternatives to a sale, such as recapitalizations, spin-offs, carve-outs, split-offs or tracking stocks.

We help clients realize value from corporate assets, with innovative strategies for optimizing business portfolios. We advise on all aspects of execution, seeking success for the original company, for newly independent companies, and for shareholders.

We help our clients to identify the best possible opportunities for acquisitions, disposals or strategic partnerships. We tailor the best strategy and timing in order to achieve the best possible results.

In advising companies on an acquisition, merger, or sale, we evaluate potential targets, provide valuation analyses, and evaluate and propose financial and strategic alternatives. We provide boards and management teams with independent judgment and deep expertise as they navigate their most important transactions and strategic decisions. We also advise as to the timing, structure, financing, and pricing of a proposed transaction as well as assist in negotiating and closing the deal.

We have an extensive track record advising clients on purchase transactions. Our experience enables us to help you identify appropriate targets, perform an effective valuation analysis, structure an offer, and conduct skilful negotiations leading to a successful close.

With deep experience in logistic services, warehousing, metals & mining, manufacturing, hospitals and healthcare systems, we focus on providing a wide range of tailored creative financial solutions.

Agora Partners provides exceptional sell-side advice to both private and public firms seeking to sell their company or divest assets/business segments with senior level resources and personalized attention dedicated to each transaction.

Capital fuels growth and provides flexibility. Agora Partner's relationships with private equity, venture capital, and lending organizations enable us to identify the right capital partner and carefully tailored offerings structures to support your company's growth objectives, acquisition-related financings, recapitalizations, and shareholder restructurings. We actively seek engagements to place senior debt (minimum $ 7 million), mezzanine finance (minimum $5 million), equity (minimum $5 million) and private equity partnership funds (no set minimum), as well as entire balance sheet restructuring assignments.

Agora Partners is a leader in structuring and executing private market transactions for our public and private corporate clients who require direct private equity, credit, or hybrid financing solutions.

Agora Partners differentiated relationships with a global network of investor decision makers enables us to connect our clients with “traditional” investors such as private equity funds, mutual funds, hedge funds, and alternative lenders as well as with an extensive network of “non-traditional” capital partners such as large family offices, global pension funds and endowments, sovereign wealth funds, insurance companies, and strategic investors.

We help our clients to raise capital, carry out refinancings, issue debentures, and access alternative and structured finance solutions that optimize terms and minimize risk.

Agora Partners provides debt solutions tailored to a client's specific capital needs. Our seasoned investment bankers provide tactical consultation, determining optimal debt capital structures and accessing the markets to meet client objectives. Through our extensive experience and relationships with investors, Agora Partners has developed a proven track record of helping financial companies raise debt capital.

Our team have detailed knowledge and insight across the debt markets including corporate debt, leveraged finance, structured finance, real estate finance and capital markets.

Our services include:

Experience with the full range of equity valuation techniques, including:

Agora Partners provides integrated advice in connection with the structuring of public and private transactions – including mergers, spin-offs, sales, joint ventures, and capital markets offerings – intended to optimize tax, accounting, and other objectives of the deal. Our team is led by the former head of the tax practice at a major law firm with over 35 years of experience in transactional work. We work closely with our clients and their legal and tax/accounting advisors to deliver the optimal structuring solutions.

Similarly, most middle market companies do not have their own, full-time Corporate Development departments as in many larger corporations. Corporate Development is a critical function for companies seeking external growth through mergers and acquisitions (M&A). Acquisitions often provide the fastest and most efficient means for companies to enter new products and markets, expand geographically (domestically and internationally), obtain new technologies, capture new customers, and achieve economies of scale.

Benchmarking is a process to compare the financial and operating metrics of your company to the industry as a whole. For example, how does your company’s gross margin compare to the average gross margin of companies in your industry?

A better metric than that of the industry as a whole could indicate that your firm is worth more than the average firm in your industry. During the sales process you might want to call out:

Benchmarking can give you an idea of what the optimum inventory level is for your industry. It may be possible to reduce inventory and pocket some cash ahead of a sale. If you don’t, you can be sure the buyer will do it right after the sale closes.

If you have a company with over $10 million in revenue, and you’d like us to perform a custom benchmarking exercise for free, email us and a representative will be in contact with you.

It has been seen in many cases that private equity/Venture funds lost the value of their investments due to certain factors like adverse market conditions, management non-performance as per the business plan, mismanagement by various stake holders, inadequate system and process designs, controls/checks etc.

Agora Partners Investment Management businesses comprise a set of companies, each highly-focused and attuned to serve the specific needs of their respective clients with customized investment advice and management expertise. This ensures that private equity/venture funds maintain their entrepreneurial focus and that their business interests remain aligned with the short-term and long-term objectives.

AGORA Partners provides advisory services to solve business challenges by Big Data Analytics, Marketing Analytics (Both Digital & Offline Marketing), Web Analytics, Fraud Analytics, Predictive Analytics, Customer Analytics and end-to-end process development for different analytical projects in E-commerce, Retail, FMCG & Pharma sectors. At Agora Partners we have experienced industry professionals and technology experts work in tandem to deliver unique insights and analytics that drive innovation. We help enterprises sharpen their business strategy by complimenting human intellect with innovative usage of big data, thus providing competitive agility and building a data analytics-driven organization.

Our firsthand knowledge of local/global players and the industry gives us insight into a variety of corporate strategies, initiatives, and acquisition objectives as well as the most up-to-date local and international market intelligence.

We provide comprehensive energy sector investment banking and advisory services in Power, Utilities & Renewables.

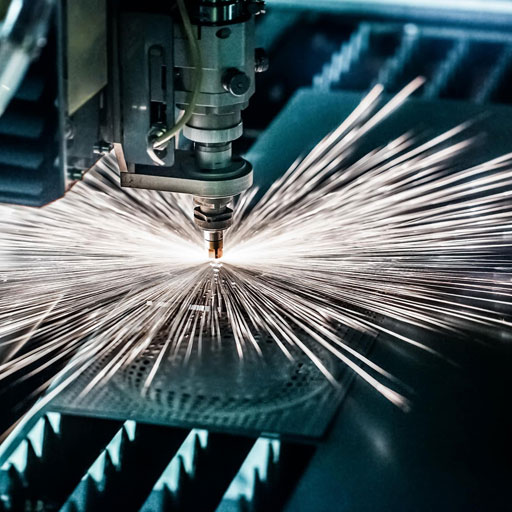

The First Industrial Revolution used water and steam power to mechanize production. The Second used electric power to create mass production. The Third used electronics and information technology to automate production. Now a Fourth Industrial Revolution is building on the Third, characterized by a fusion of technologies that blur the lines between the physical, digital, and biological spheres. AI, SaaS, cryptocurrency & distributed ledger technology, cybersecurity, and managed services are all part of this transformation. Agora Partners maintains longstanding relationships with the companies and funds that invest in this sector and is perfectly positioned to help clients achieve their goals.

Exclusive financial advisor to Handy Networks

Exclusive financial advisor to CoinProphet

Financial advisor to Rio Tinto

Financial advisor to SunEdison

Exclusive financial advisor to Superior Highwall Miner

Exclusive financial advisor to SpanDeck, Inc. (Mantis Cranes)

Exclusive financial advisor to Tennessee Farmers Insurance Company

Exclusive financial advisor to The Broe Group

Financial advisor to Milestone Equipment

Financial advisor to Phillips Machine Service, Inc.

Financial advisor to Project XYZ

Financial advisor to Quantum Technology Sciences

Financial advisor to TriVector Services, Inc.

Financial advisor to Two Rivers Pipeline

Financial advisor to VAR Technology Finance

Financial advisor to ZETA Pellet

A good deal gets even better with an experienced banker on your side Steve Antoline, CEO of Superior Highwall Miners (SHM), received a bid of $120 million for his mining equipment company located in Beckley, WV. He retained us to advise him on the sale. Over six months, we ran a structured auction process, and SHM closed the sale to Tennessee Valley Ventures for $150 million. That’s more than 20% higher than the initial offer. A good investment banker can add value, even if you already have a deal on the table.

An auction process can increase your price even when there’s only one bidder In some industries, there is a limited number of buyers. Bill Mitchell of Mantis Cranes experienced this when he decided to retire and sell his crane business. We ran an auction process and negotiated with the buyer to the very end of the process, even though we were dealing with only one bidder at the end. The seller was delighted with the final sales price of $37.5 million. Experience in business sales process is as valuable as negotiation experience.

Real-world valuations are critical for good negotiations We’ve performed hundreds of valuations for companies to let them know their real-world value. That is the amount an institutional investor will pay for your company this year, as opposed to IRS Fair Market Value guidelines used for tax purposes. In 2020 we were engaged by a cybersecurity firm which we estimated was worth $25-30 million. They received three bids for their firm: two at $27.5 million and one at $30 million. Those are typical results for our real-world valuation. In 15 years, we’ve never been off by more than 10%.

It is important to know when to say no Trivector services, an aerospace & defense engineering firm, retained us to advise them on the acquisition of an Israeli UAV manufacturer. After reviewing information, traveling to Israel to meet with the firm, and conducting due diligence, we unearthed concerns that would have been easy to overlook. We recommended that Trivector not pursue the acquisition. Trivector was glad to have an advisor that was willing to be honest even if it meant delivering bad news. Since then, they’ve grown into a great company with a strong future. They have also retained us on five additional occasions for advisory work.